The General Economy

Once again, prognostications of a recession were premature, thanks to sustained consumer spending and a residential construction rebound. Third quarter annualized Gross Domestic Product (GDP) advanced a healthy 3.5 percent. A surge in new home construction pushed annualized Residential Fixed Investment up by an astounding 6.1 percent and served as a contributor to economic growth for the first time in many quarters. Personal Consumption Expenditures (PCE) grew at a rate almost double that of the second quarter. Heavy summer travel and purchases of back-to-school items such as computers and clothes reflected people’s enduring demand, so much so that credit card usage1 and delinquencies2 crept up to pre-pandemic heights.

Both inflation and unemployment generally moved in the desired direction, which encouraged the Federal Reserve (The Fed) to hold rates at 5.5 percent in September. The annual Consumer Price Index (CPI) in both August and September was 3.7 percent, despite OPEC (Organization of the Petroleum Exporting Countries)-induced oil price escalation. The Fed pays closer attention to core CPI, which excludes volatile food and energy prices. This figure slid steadily throughout the summer as shelter costs reduced from peak numbers. The tight employment situation softened slightly. Unemployment meandered up to 3.8 percent. This was partially due to layoffs, but higher wages and lower growth in personal income also drew more people back into the job hunt.

The Real Estate Sector

Residential

The difficult market conditions from the second quarter carried into the third, suppressing home sales. The 30-year fixed mortgage rate rose to over 7.3 percent and exacerbated already tight credit availability. Total home sales were down nearly 9 percent compared to last year, as homeowners stayed “locked” into low-rate mortgages, further contributing to the lack of existing homes on the market. Although sales cooled, supportive demographic factors and “life-event” movers created some demand. Moreover, there were signs that the 7 percent threshold for mortgage interest rates was not as significant as expected. As the Mortgage Bankers Association (MBA) recently noted, “Despite the 30-year fixed rate averaging over 7 percent in August, applications for new home purchase loans increased over the month and from a year ago.” Home construction rebounded in response, with single family starts up almost 20 percent since the first quarter. But the higher new home inventory couldn’t satisfy the market. The median price of both new and existing homes bounded up, driven by the mismatch between supply and demand.

Commercial

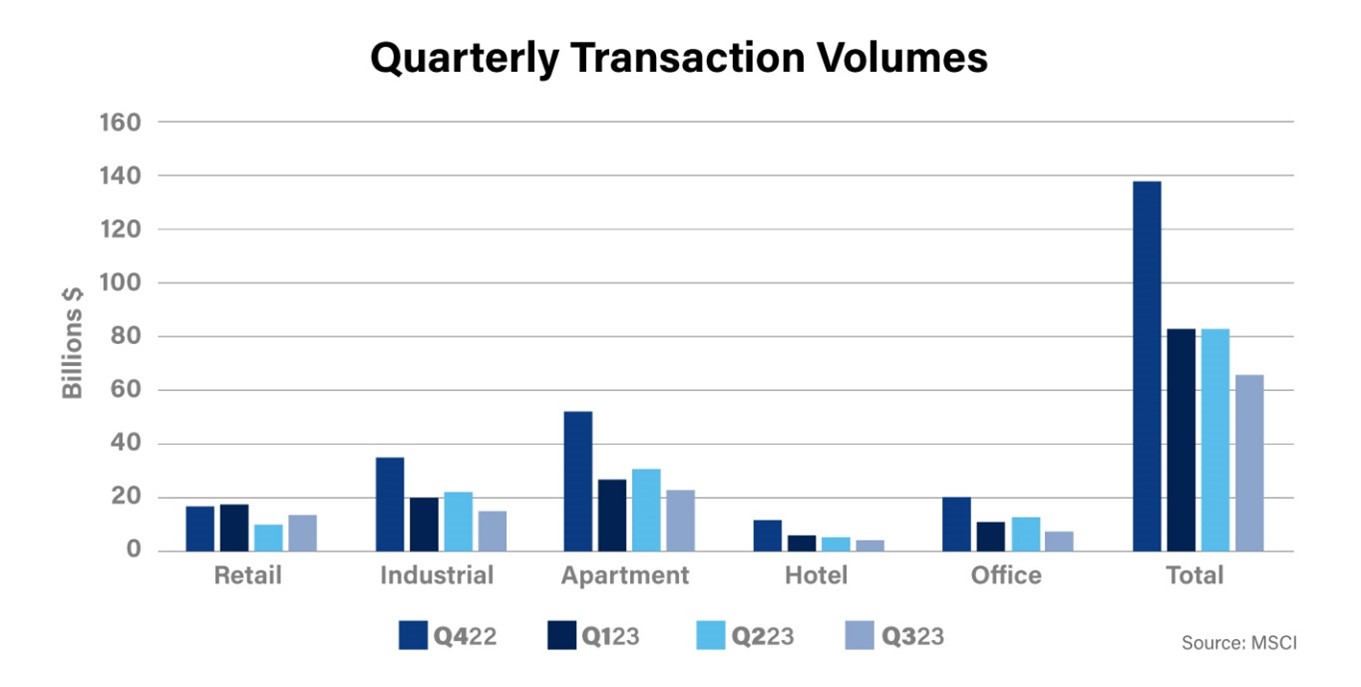

Transaction volumes were off by 60 percent and prices down 9.9 percent year-to-year in August, according to MSCI. Given the soaring interest rates and credit tightening, the direction of the market was not a surprise. But the magnitude of the year-to-year change caused unease for commercial real estate investors and banks. As MSCI recently noted, given the robust deal activity in 2021 and 2022, the yearly figures are less concerning. Moreover, looking at quarter-to-quarter data provides a different view. Price adjustments, tenacious economic growth and less uncertainty over the path of interest rates may have started a thaw in the market. While quarterly data can be volatile, transaction volumes this year stabilized near the bottom, rather than continuing their unrelenting downward trajectory. Most of the asset classes saw a slight uptick in transactions in Q2 2023. Preliminary Q3 2023 figures reveal pockets of growth. Retail drew positive investor attention; vacancy rates3 remained at a low 4.2 percent and store openings surpassed high-profile closings. Full-service hotel transaction volume skipped up as well.

The apartment and industrial sectors’ performance was uneven this year, but their fundamentals remained strong. According to the National Association of REALTORS® (NAR), apartment transaction volume was hit by concerns over a temporary spike in units delivered to the market and the volume of loans coming due. But a willingness by lenders to make loan modifications and improved absorption rates4 kept anxiety at bay. A surge in new space and normalizing trends also weakened the industrial market performance, but rents remained healthy, per JLL. The emergence of the “Battery Belt” strengthened the asset classes’ longer-term attractiveness. New electric vehicle (EV) battery factories, spurred by the Inflation Reduction Act, are planned for many auto-producing states, including Michigan, Tennessee and Kentucky.

While concern over the Office sector is still very much warranted with rising vacancy rates4 and an increased number of distressed properties, a swell of sales has not yet occurred. One reason may be that lenders heeded The Fed’s call for loan modifications. Another may be that investors and office managers waited for a Labor Day return-to-office movement, and lived with a summer of underutilized office space.

A Glimpse Forward

It’s too soon to know if we are in the “goldilocks” scenario that the Fed is targeting. Recessionary clouds on the horizon include the resumption of student loan payments, a protracted United Auto Workers strike, the depletion of pandemic program-related savings and a possible government shutdown in November. Moreover, the war in Israel could have wider implications, including oil price increases. But the consumer has proved very resilient and holiday spending and travel are just around the corner.

Fannie Mae forecasts PCE annualized growth to stay positive at 1.7 percent and along with it, GDP growth at 1.2 percent. The Fed’s own Summary of Economic Projections shows an additional increase in the Federal Funds rate before the end of the year in response to the health of the economy. But if core inflation and unemployment soften more than expected, or the clouds darken, this move may not be necessary.

In the residential market, Fannie Mae’s Home Purchase Sentiment Index® (HPSI) for September revealed that interest rate sensitivity returned as the main determinate of market activity (rather than inventory and pricing). The MBA expects rates to taper down in 2024, supporting a rebound in sales. In CRE, some are warning of a “doom loop,” where the fall in office property prices leads to bank losses and a recession and more office vacancies. Others note that a robust return-to-office, continued loan modifications, declining unit deliveries and investors waiting in the wings may make the “loop” less dramatic. The market would certainly welcome a little less drama headed into 2024.

1 Federal Reserve Bank of Philadelphia, Large Bank Consumer Credit Card Balances: Total Balances [RCCCBBALTOT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/RCCCBBALTOT, October 12, 2023.

2 Board of Governors of the Federal Reserve System (US), Delinquency Rate on Credit Card Loans, All Commercial Banks [DRCCLACBS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DRCCLACBS, October 12, 2023.

3 Copyright ©2023 “August 2023 Commercial Real Estate Market Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. October 2023, https://www.nar.realtor/blogs/economists-outlook/commercial-real-estate-market-insights-august-2023?g=173096

4 Copyright ©2023 “September 2023 Commercial Real Estate Market Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. October 2023, https://www.nar.realtor/commercial-real-estate-market-insights/september-2023-commercial-real-estate-market-insights