The real estate market in 2023 was marked by high volatility, low inventory and soaring prices, making it one of the most challenging years for buyers and sellers alike. However, as we enter 2024, there are signs of improvement and stabilization in the housing sector. Let’s review the fourth quarter of 2023, then glance forward to 2024 forecasts.

The Residential Market

The housing market showed its dynamic nature in the fourth quarter, despite some disquieting headlines. A lack of homes for sale reaccelerated prices, which grew 6.3 percent year-over-year in October. After rising all year, the 30-year fixed rate mortgage spiked to almost 8.0 percent in October as well. Consequently, existing home sales fell below 4 million units for the quarter, a level not seen since 2008. Demand was evident in new home sales. Despite more difficult borrowing conditions, builders responded to the market by offering price concessions and smaller homes. The Federal Reserve (The Fed) maintained its rate at 5.5 percent1 throughout the quarter, prompting observations that the inflation “fever” may have broken. This news helped pull down interest rates, which fell to 6.6 percent by year-end, prompting unusual fourth quarter activity. Single-family starts and permits jumped, while new purchase mortgage applications increased 21.8 percent in November.

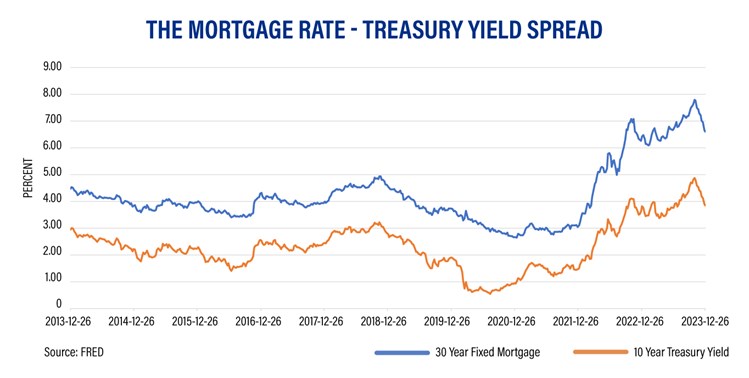

With mortgage interest rate sensitivity so evident, more attention was paid to its main drivers: the 10-year treasury note yield and the spread lenders add to it. As the graph below shows, yield changes in 2023 were dramatic.

This movement was driven by the anticipation of The Fed’s interest rate path, the continuation of U.S. deficits and demand for U.S. securities as a safe haven. The mortgage spread was about 120 bps wider than in past years, compounding the impact on borrowers. According to the President of the Mortgage Bankers Association (MBA), the political environment with the debt-limit crisis and gridlock layered on top of economic uncertainty pushed up the spread.

Continuing Quantitative Tightening (QT) also contributed to increased mortgage rates. The Fed has intentionally reduced its holdings of Mortgage-Backed Securities (MBS), removing itself as a significant buyer in the MBS market, which consequently raises funding costs for lenders. Despite calls from some housing market organizations to reconsider QT, Chairman Powell explicitly stated in December that The Fed has no intentions of doing so in the near future.

The Commercial Market

The peaking of commercial interest rates in the early fall suppressed Commercial Real Estate (CRE) deal activity in the usually busy fourth quarter, according to MSCI. Transaction volume dropped from October to November, and was down 60 percent year-to-year by the end of the month. While prices softened further, the pace moderated. Performance across the sectors was mixed. Elevated apartment construction impacted the attractiveness of the sector and activity. For industrial properties, deal volume was also down significantly, but prices stayed positive due to rent rate growth of 15.3 percent, as tracked by JLL.

MSCI’s preliminary data for Q4 indicated that office, retail and hotel transactions were on par with the previous quarter. The Office sector continued its adjustment; price declines accelerated and some distress worked its way through the pipeline. According to Bisnow, deed in-lieu-of-foreclosure transactions outpaced averages set in 2022 and before the pandemic. Hotel prices were stable, helped by the return of foreign tourists and the “Taylor Swift effect” of fans flocking to concerts nationwide. MSCI’s November Capital Trends report noted that the period of worry over retail properties seems to have passed. The vacancy rate2 remained near 10-year lows and in-store shopping was very robust this holiday season. Retailers who survived the pandemic have adapted, occupying smaller stores and moving to freestanding retail space.

A Glance Forward

In December, The Fed signaled that the tightening cycle was likely at its peak. The first of potentially three rate cuts could come in early spring. By then, the economy could be showing sufficient signs that it will not reheat. According to the Federal Reserve Bank of San Francisco, annualized Gross Domestic Product (GDP) growth could slow due to depleted pandemic-related excess savings. GPD could also lag due to persistently high consumer credit rates and further credit tightening caused by the expiration of a special program supporting smaller banks. Economists expect the job market to soften a bit and that inflation will be less of a concern. Fannie Mae forecasts that Consumer Price Index will settle around 2.6 percent in Q1 2024, creeping closer to The Fed’s 2 percent target.

Commercial Real Estate (CRE) investors have been on the sidelines waiting for lower rates to boost valuations and refinancing prospects. One investment bank recently speculated that leasing and capital markets could benefit from optimism over falling interest rates and demand for top-tier office space.

The MBA forecasts a residential market turnaround beginning in Q1. Total home sales for the year are projected to grow 6.5 percent and single-family starts by almost 11 percent. Much-needed existing inventory could rise significantly, as many sellers can no longer delay listing. A clearer Fed path and lower inflation are expected to push down treasury yields, normalize mortgage spreads and thus, put mortgage rates close to 6 percent by year-end. Given these factors, the market is expected to be unusually strong for a presidential election year.

In 2024, consumers, builders, borrowers and investors are looking forward to a reprieve from punishing interest rates and the real potential for The Fed’s projected soft landing.

1 Board of Governors of the Federal Reserve System (US), Federal Funds Target Range - Upper Limit [DFEDTARU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFEDTARU, January 5, 2024.

2 Copyright ©2023 “October 2023 Commercial Real Estate Market Insights.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. January 2024, https://www.nar.realtor/commercial-real-estate-market-insights/october-2023-commercial-real-estate-market-insights